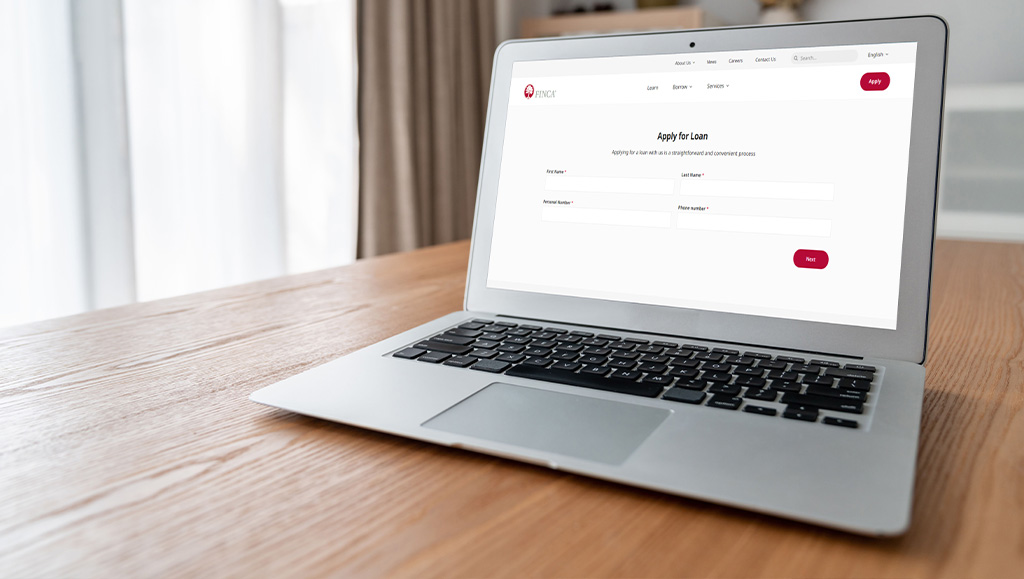

The Benefits of Applying Online

In today's fast-paced digital era, the convenience and efficiency of online processes have revolutionized various aspects of our lives, including the way we apply for loans. Online loan applications offer a myriad of advantages that make the borrowing experience smoother and more accessible for individuals. Here are some key benefits: